Beyond Minimizing Taxes: How Strategic Tax Planning Fuels Your Financial Vision ⛽

Strategic tax planning is an essential component of comprehensive wealth management.

Cheers to a Long Life…but is it a blessing or a curse?

Cheers to a Long Life…But is it a Blessing or a Curse? Longevity risk can put your financial life under stress. We work with our clients to develop financial plans to help mitigate longevity risk so you can enjoy your life fully.

Is Your Wealth a Train-wreck Waiting to Happen? A Proactive Approach to Risk Management for High-Net-Worth and Ultra-High-Net-Worth Individuals and Families

Wealth building is tough enough but wealth preservation is key to avoiding financial train wrecks. Learn more about how we focus on personalized risk management for our clients.

The Silent Threat: Protecting Your Wealth in the Age of Cyber Warfare

In today's interconnected world, cyber threats are no longer just a concern for businesses; they pose a significant risk to individuals as well, especially those with substantial wealth.

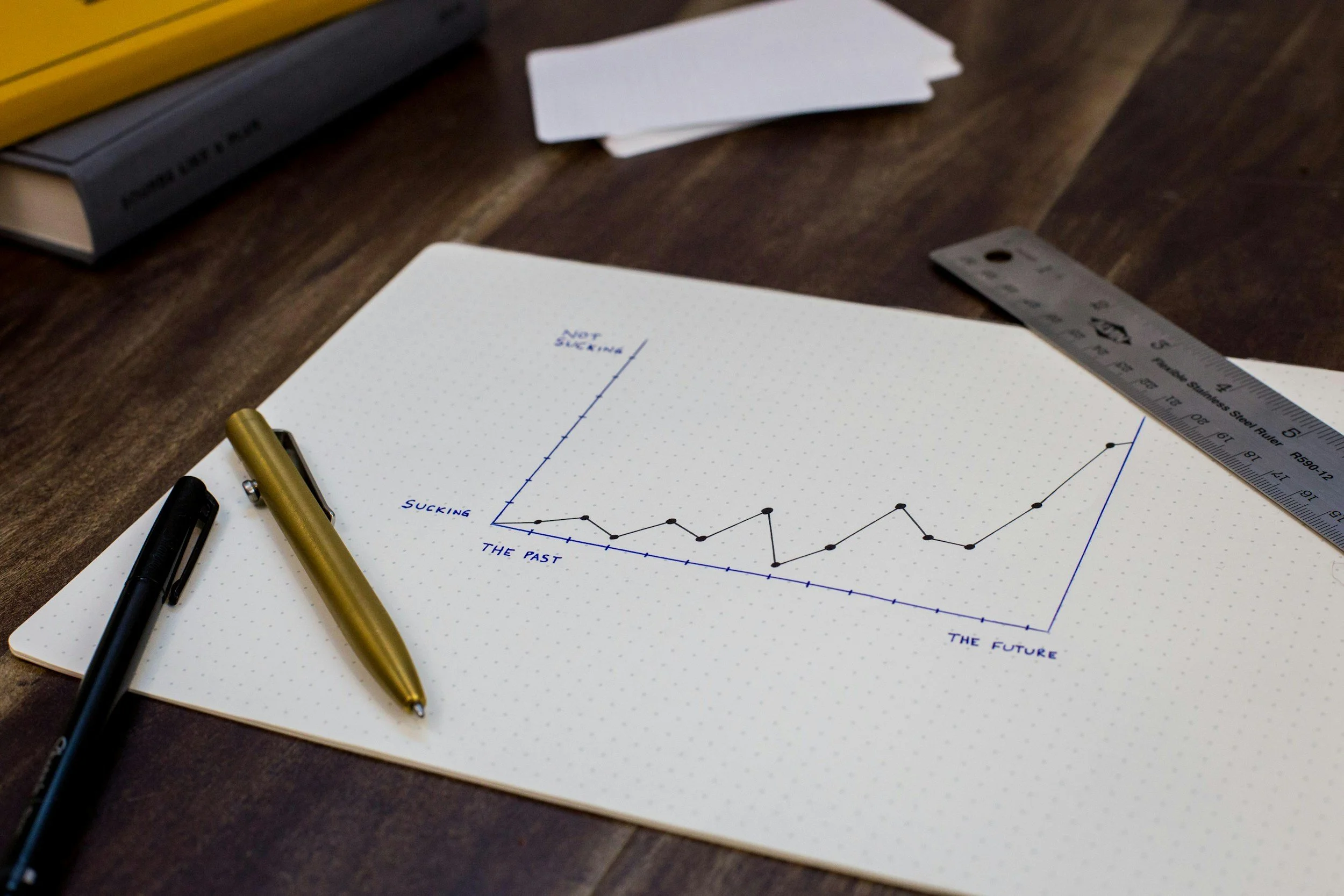

The Power of Incremental Progress: Small Steps, Big Financial Changes

Small steps lead to big changes. This fundamental principle applies to financial planning, especially for sophisticated women who are navigating complex financial landscapes. By breaking down overwhelming goals into manageable actions, you can create a clearer path to financial security and independence.

Don’t forget to celebrate your small victories. Each milestone you accomplish is a step towards your larger goal. Acknowledging these achievements will keep you motivated and reinforce the belief that small actions genuinely lead to significant, positive changes in your financial future. Embrace the journey, and remember that progress is made one step at a time.

Life Lessons and The Value of Time

Understanding the value of your time is essential in financial planning, especially for busy women juggling various roles. Time is limited, so knowing its worth can improve your decisions about investments, careers, and personal life.

To find out the value of your time, calculate your hourly rate based on your income. This gives you a starting point to see how much you earn per hour. Next, assess whether your activities provide similar value to your life or finances.

Consider the opportunity cost of how you spend your time. If you dedicate an hour to a task that could be delegated, you might miss out on more valuable activities like career advancement, networking, or personal leisure.

Think about the emotional benefits of your time, too. Engaging in fulfilling activities boosts overall well-being, which helps with productivity and financial decisions.

Recognizing the value of your time enables choices that support your financial goals and personal values. Managing your time well allows you to focus on pursuits that enhance both your wealth and quality of life.